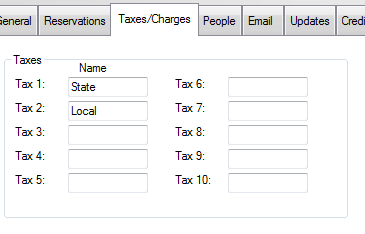

Sales Tax can be tracked automatically in Lodge Vault on all charges and unit rates. Each applicable tax at your property should be configured in Tools > Options on the Taxes/Charges tab.

Examples of common taxes include:

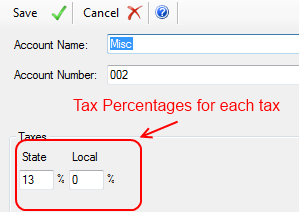

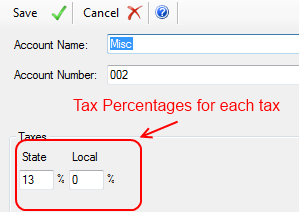

Revenue Accounts contain the actual tax percentages for each tax. The Revenue Dialog has text boxes for each tax that you've configured for your property. These percentages can be different for each revenue account and they will determine the amount of sales tax that is calculated for each charge that is attached to the revenue account.

The Finance Section contains numerous revenue reports that display sales tax totals for a time given period.

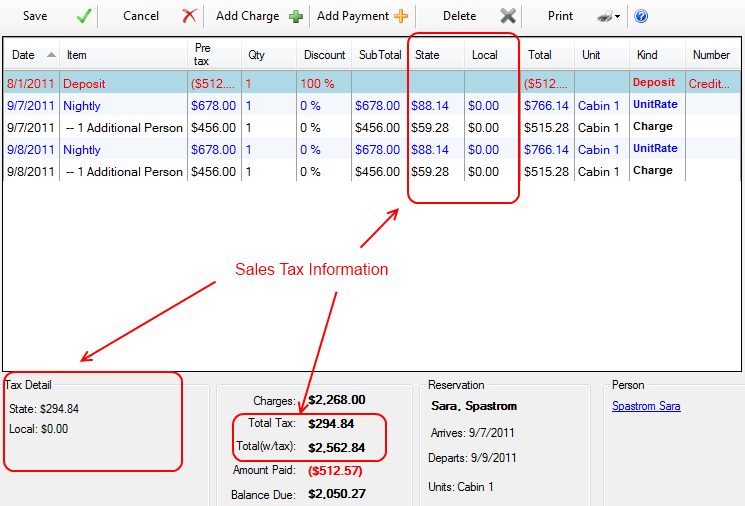

Invoices have a section on the lower left that display total sales tax and a break down for each sales tax. Each charge on the invoice has a sales tax amount for each tax.