Revenue Accounts provide a way to divide up your charges into separate categories. Each Unit Rate and POS Item has a specified Revenue Account wich determines it's behavior in the Finance section. When a new charge is added to an Invoice, the amount of the transaction will added to the total for the specified revenue account.

Some common examples of Revenue Accounts are:

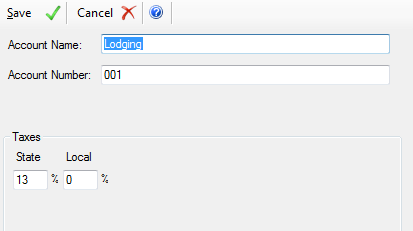

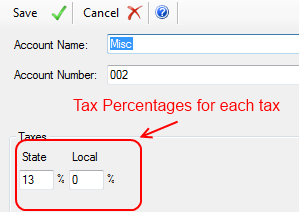

Revenue Accounts are also important for sales tax. A tax percentage is specified for each tax that you've configured in Tools > Options. Each Revenue Account has tax percentages that are applied to a related charge when they are added to an invoice. This amount can be zero for tax exempt charges or can vary by revenue account for other items. For example you can have one sales tax called Local that is 7% for Dining and 13% for Lodging. Each revenue account has an account name and an account number.

The accounts are also important if you are exporting to an accounting package (such as Quickbooks) because each revenue account will get created in your accounting package if it does not already exist. If it does exist, the charges will be added to the same account in your accounting package as the matching name in Lodge Vault.

To manage Revenue Accounts go to Configuration Section > Revenue Accounts and click a command button in the toolbar or double click an account.