Unit Rates are charges that are added to invoices during the booking process that are directly related to the rental of units. Typically these will be charges that result from the sale of a unit over a period of time or on a per person basis. Each Unit Rate must be associated with a Revenue Account.

Unit Rates are managed with the Unit Rate Dialog in the Configuration Section.

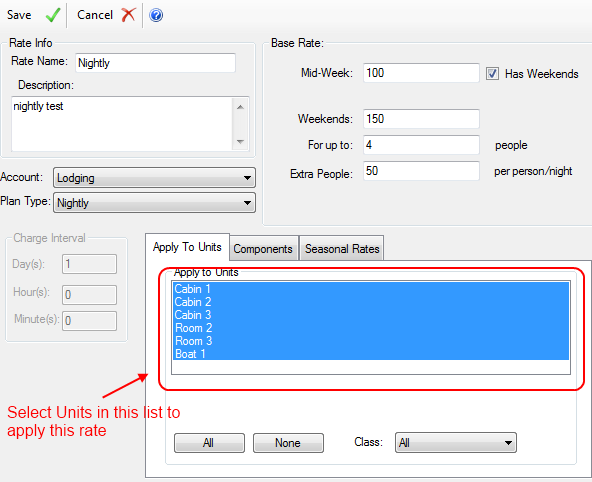

Each Unit Rate can be applied to multiple units. When applied to a unit, the rate can be selected on the Rate Selection dialog during the booking process.

Seasons define the different prices that can be applied for different times of the year. Beginning and ending dates are set to allow that price to be chosen when completing a new reservation.

Plan Type defines the behavior of the rate and how it's calculated. There are multiple plan types to choose from and each will calculate the price of a unit differently based on a time period or number of guests. Examples include:

Each unit rate is applied to one Revenue Account which will add charges categorized under that account. It also will define the calculation sales taxes for charges related to this rate.

Components allow you to define specifically how charges are added to an invoice under this rate. You can specify that a portion of the rate will go under multiple different charge types and sales tax rates. For example if your base rate is set to a price of 100, you can specify 70 toward Lodging and 30 toward Dining revenue accounts. The sales taxes will be added at the same rate as each item's subsequent account.